Electronic Payment Processing Terminal for Small Business Owners

Company : Lumi Business

At Lumi Business, we recognized that while our platform was helping small business owners manage daily operations like banking and inventory, there was a critical gap in the payment process. Many business owners were uncomfortable with relying solely on bank transfers, which led to customer churn and impacted their overall business performance. This discomfort often stemmed from concerns about the security and speed of these transactions, making it clear that a more reliable payment solution was needed.

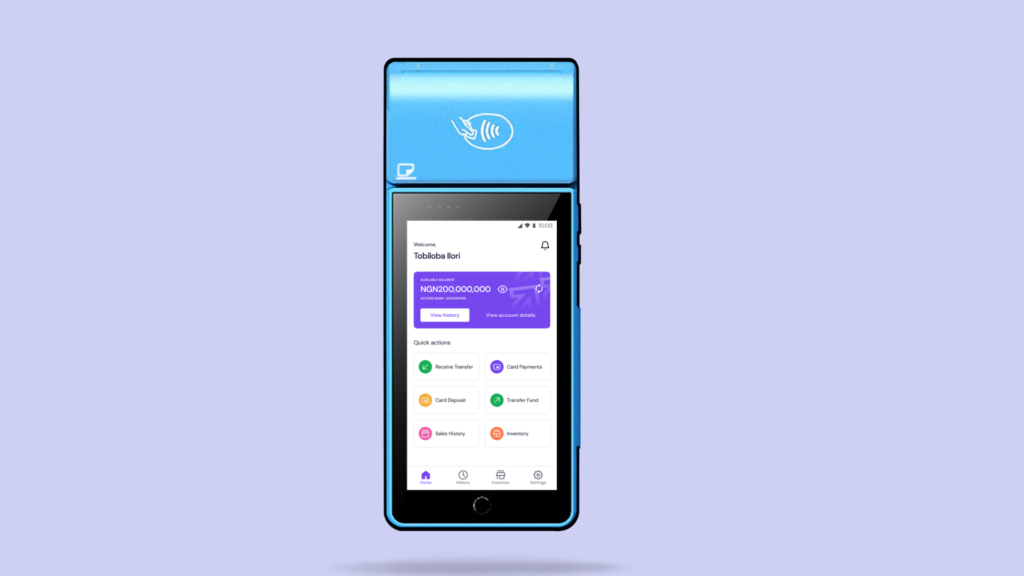

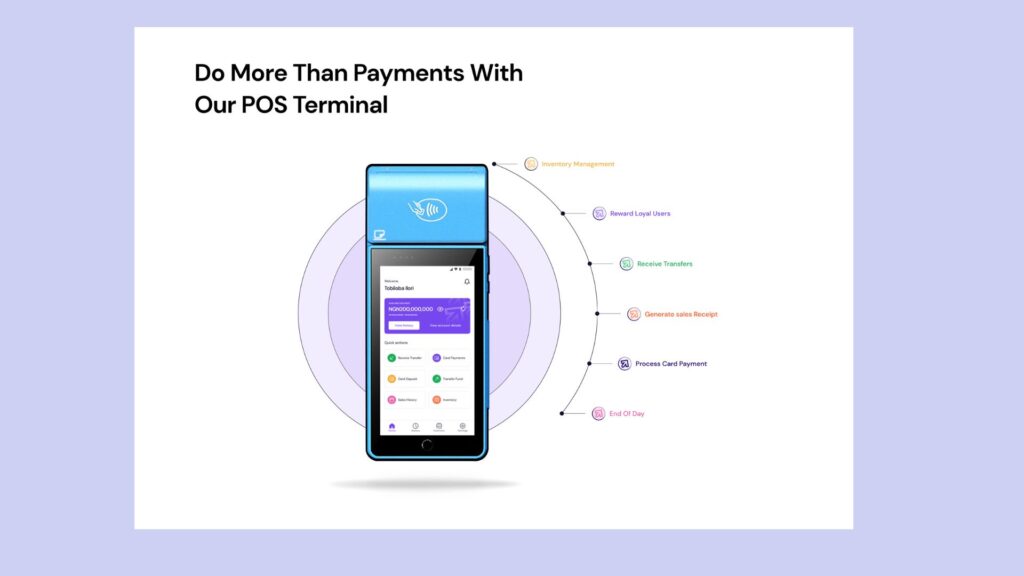

As Product Manager, I took the lead in developing a Payments Point of Sale (POS) terminal specifically designed to address this issue. Our goal was to create a card machine that not only offered secure and seamless transactions but also integrated directly with the business owners’ bank accounts. This solution needed to be both user-friendly and trustworthy, ensuring that funds were settled into their accounts by the end of each business day

- Industry: Financial Technology (FinTech)

- Product: Payments Point of Sales (POS) Terminal

Target Users

- Small Business Owners

- Freelancers

1. User Research

- Surveys: Sent out surveys to understand the needs and pain points of business owners, particularly their discomfort with bank transfers.

- Market Research: Evaluated potential partners like Payment Switches and Acquiring Banks to ensure a reliable and scalable POS solution.

- Direct Interviews: Conducted interviews with business owners to gain deeper insights into their daily challenges and refined the product accordingly.

2. Design & Prototyping

- Wireframes & Design: Created wireframes using Figma based on user feedback, leading the design process to ensure the POS terminal was intuitive and user-friendly.

- Usability Testing: Conducted testing with business owners to validate design concepts and make necessary iterations for a better user experience.

3. Competitive Analysis

- Market Gaps: Identified gaps in competitor offerings and positioned Lumi’s POS terminal as a superior solution for small business needs.

- Cost Analysis: Analyzed costs and worked with OEMs to deliver a cost-effective yet high-quality product.

- Compliance: Ensured the POS terminal met regulatory standards by obtaining necessary licenses or leveraging partnerships.

4. Roadmap & PRD

- Strategic Planning: Developed a roadmap that prioritized key features and aligned with business goals.

- Product Requirements: Created a detailed PRD that outlined essential features and technical requirements, ensuring all stakeholders were aligned.

5. Development & Testing

- Agile Process: Managed the development process using Jira for sprint planning and tracking, ensuring timely delivery of features that addressed user pain points.

- Pilot & Launch: Managed the pilot rollout and collected feedback to fine-tune the product before a full-scale launch.

6. Product Launch Plan

- Launch Strategy: Developed a comprehensive launch plan that included both internal and external preparations. This plan involved coordinating with the marketing team to create compelling messaging, promotional materials, and launch events that would drive awareness and adoption of the POS terminal.

- Marketing Collaboration: Worked closely with the marketing team to create campaigns that effectively communicated the product’s value proposition. This included SEO optimization, social media campaigns, email marketing, and content creation for blogs and press releases.

- Stakeholder Alignment: Ensured that all key stakeholders, including sales, support, and operations teams, were fully briefed and aligned on the launch strategy and product details.

- NFC Enabled: Supports contactless payments, aligning with modern consumer habits.

- End-of-Day Settlement: Automatically transfers funds to business accounts, reducing manual effort.

- QR Payments: Offers flexibility with QR code payments.

- Transfer Notifications: Provides real-time alerts for incoming transfers.

- Receipt Printing: Allows for both receipt printing and reprinting.

- Anti-Fraud Measures: Integrated features to prevent fraudulent activities, giving business owners peace of mind.

- Transaction Volume: Processed over $2 million daily, demonstrating the system’s reliability and scalability.

- Merchant Growth: Simplified onboarding processes, leading to a significant increase in new business users, including large merchants.

- Revenue Increase: Contributed to substantial revenue growth through hardware sales and transaction fees.

- Efficiency: Ensured minimal downtime by integrating a backup provider, maintaining continuous service for business owners.

- Challenge: Frequent network issues with the initial payment switch caused potential downtime.

- Solution: Integrated a backup provider, enabling seamless switching and maintaining consistent transaction processing, which directly addressed the reliability concerns of business owners.