Funds Marketplace For Registered Investments Advisors

Company : Qdeck

Overview

Role & Tasks

Features

Achievements

Challenges & Solutions

Overview

The Problem:

Registered Investment Advisors (RIAs) often struggle with the complex and time-consuming process of managing and optimizing their clients’ investment portfolios. Finding the right funds, balancing portfolios, and generating detailed reports can be overwhelming and inefficient.

At Qdeck, I led the development of a Fund Marketplace to simplify this process. The platform brings together a wide range of funds, allowing RIAs to easily select, manage, and optimize investments. It also provides tools for portfolio rebalancing and comprehensive reporting, helping RIAs make better decisions and deliver stronger results for their clients.

- Industry: Financial Services & Investment Management

- Product: Fund Marketplace Platform

Target Users

- Registered Investment Advisors (RIAs)

- Wealth Managers

- Financial Planners

- Investment Firms

Role & Tasks

1. User Research & Market Analysis

- Advisor Needs Assessment: Conducted detailed interviews and surveys with RIAs and wealth managers to identify the key features and tools they require for effective portfolio management.

- Market Analysis: Analyzed existing platforms and investment tools to identify gaps and opportunities, ensuring that Qdeck’s Fund Marketplace offered a unique and compelling value proposition.

2. Product Development

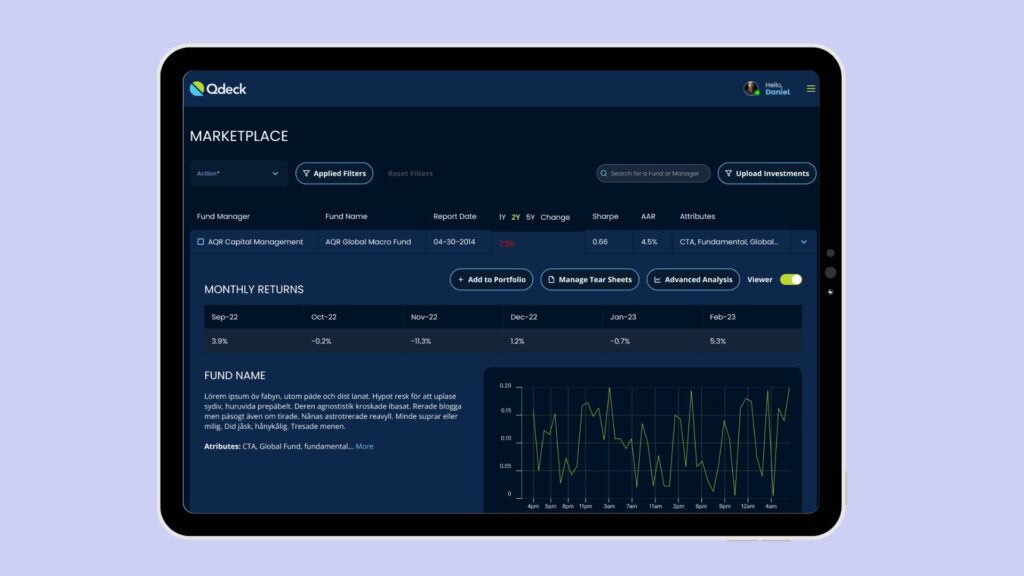

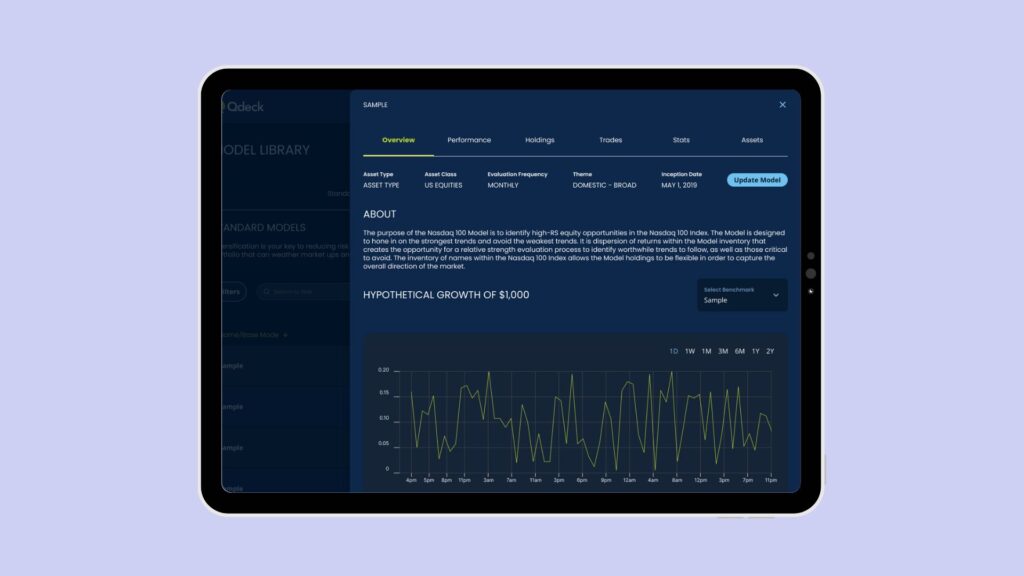

- Feature Development: Led the creation of core features such as fund selection, portfolio weighting, rebalancing tools, and detailed fund reporting. Ensured that the platform was user-friendly and equipped with the necessary functionalities to support complex investment strategies.

- Fund Filtering & Metrics: Developed advanced filtering options that allow users to sort and filter funds by various criteria, including fund performance, market cap, sector, and other key metrics. This helps RIAs make data-driven decisions when constructing portfolios.

- Comprehensive Reporting: Integrated detailed fund reporting tools that provide insights into the past, present, and projected performance of funds, enabling RIAs to monitor and adjust their clients’ portfolios effectively.

- Investment Data Integration: Loaded over 500 funds, stocks, and investment data into the platform, ensuring that users have access to a broad and diverse set of investment options.

3. Product Launch

- MVP Launch: Successfully launched the MVP of the Fund Marketplace, focusing on core functionalities that addressed the immediate needs of RIAs while allowing for future enhancements based on user feedback.

- User Acquisition: Developed and executed strategies to onboard RIAs and investment firms, emphasizing the platform’s ability to simplify and enhance the portfolio construction process.

4. Post-Launch Optimization

- Continuous Improvement: Monitored user feedback and usage patterns post-launch to identify areas for improvement and drive iterative enhancements to the platform.

- User Engagement: Implemented strategies to drive ongoing user engagement, ensuring that RIAs fully leveraged the platform’s features to optimize their investment decisions.

Features

- Fund Selection & Portfolio Weighting: Allows RIAs to easily select funds from the marketplace, assign portfolio weights, and construct well-balanced investment portfolios tailored to their clients’ needs.

- Rebalancing Tools: Provides RIAs with tools to rebalance portfolios, ensuring that client portfolios remain aligned with their investment goals and risk tolerance.

- Advanced Filtering Options: Offers robust filtering capabilities, enabling users to sort and filter funds by performance metrics, market cap, sector, and other key criteria, facilitating data-driven investment decisions.

- Comprehensive Fund Reporting: Delivers detailed reports on the past, present, and projected performance of funds, giving RIAs the insights they need to monitor and optimize their clients’ portfolios.

- Investment Data Integration: Provides access to over 500 funds, stocks, and investment data, giving users a wide range of options to choose from when building portfolios.

- Future & Present Stock Performance Metrics: Allows users to view and analyze the future and present performance of stocks and funds, supporting informed investment decisions.

Achievements

- Broad Fund & Stock Integration: Successfully integrated over 500 funds, stocks, and investment data into the platform, providing RIAs with a diverse set of options for portfolio construction.

- High User Satisfaction: Received positive feedback from RIAs who appreciated the platform’s ease of use, comprehensive filtering options, and detailed reporting capabilities.

- Increased Efficiency: RIAs reported significant improvements in their ability to construct, manage, and optimize portfolios for their clients, leading to better investment outcomes.

Challenges & Solutions

- Challenge: Initial feedback indicated that some RIAs required more granular filtering options and additional metrics for fund analysis.

- Solution: Expanded the platform’s filtering capabilities and integrated additional performance metrics, enabling RIAs to conduct more detailed and nuanced analyses when selecting funds.