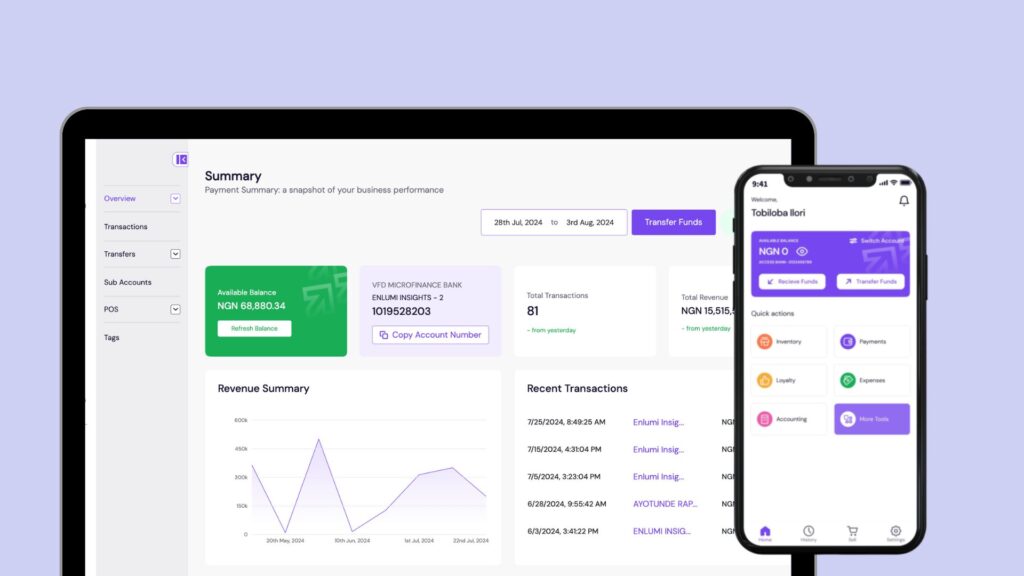

Business Banking Web & Mobile App for Small Businesses

Company : Lumi Business

Lumi Business was founded to fill a critical gap in the market: small business owners often struggled to find banking solutions that truly catered to their unique needs. Traditional banks frequently offered one-size-fits-all services that didn’t align with the specific challenges small businesses face in managing their finances and daily operations. This lack of tailored banking solutions left many business owners feeling unsupported and overwhelmed.

To address this gap, the long-term vision for Lumi Business was to create a comprehensive platform that not only provided banking services but also integrated a suite of tools to streamline business operations and enhance financial management. As part of this vision, I led the development of a digital banking app designed specifically for small business owners.

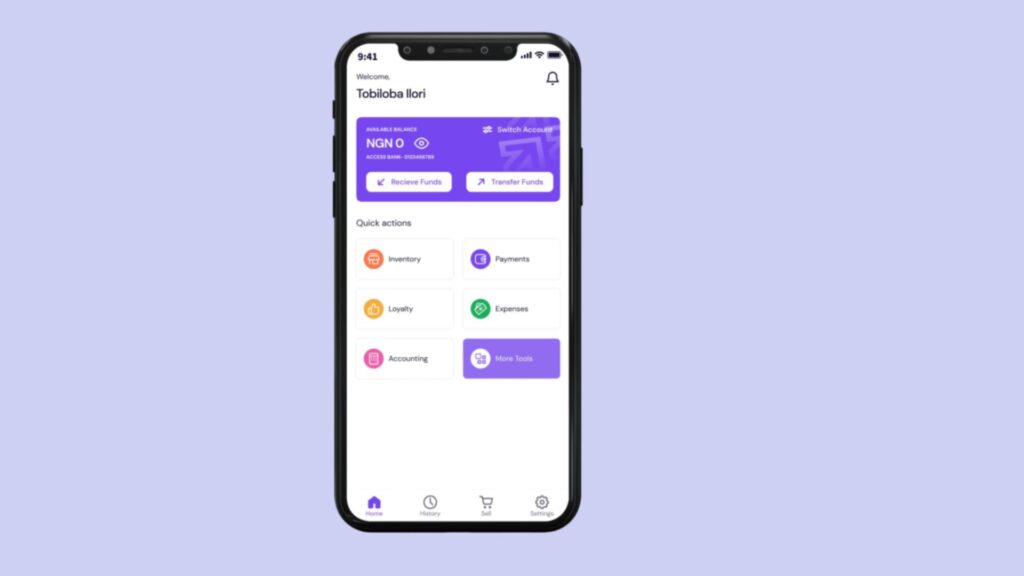

The objective of the app was straightforward yet powerful: enable business owners to easily create business bank accounts, receive payments, and transfer funds, all from a single, user-friendly platform. This digital banking app was built to provide the functionality and flexibility that small businesses needed, allowing them to manage their finances more effectively without the complexity and inefficiencies often associated with traditional banking solutions

- Industry: Financial Technology (FinTech)

- Product: Digital platform for small business banking, including web and mobile applications

- Market and Competitive Analysis: Conducted a comprehensive competitive analysis of current market players, identifying key opportunities and strategic entry points for the new product. This analysis was instrumental in positioning the product to address unmet needs in the market, setting the foundation for a successful launch.

- SME Insights and Pain Points: Partnered with a leading research agency to conduct in-depth interviews with local SMEs, uncovering critical insights into their pain points with traditional banking systems. These insights directly informed the product’s feature set, ensuring it addressed real-world challenges faced by SMEs.

- MVP Definition and Scope: Based on extensive market research and SME feedback, defined the scope of the MVP solution. This involved prioritizing features that offered the highest value to users while ensuring the product could be delivered within the set timeline and budget constraints.

- Product Design and Validation: Created the initial wireframes for the product, which were then translated into high-fidelity designs. These designs were validated through focus groups with SMEs, ensuring the product met user needs and expectations before development began.

- Regulatory Compliance and Risk Mitigation: Played a key role in ensuring the product met all necessary regulatory compliance requirements. Collaborated with legal and compliance teams to identify potential regulatory risks early in the development process, incorporating necessary safeguards into the product design and launch strategy. This proactive approach minimized the risk of regulatory issues post-launch.

- Go-to-Market Strategy and Launch: Led the development and execution of the go-to-market strategy, which included drafting the initial press release for tech blogs, generating buzz, and driving early user adoption. This strategy was aligned with the broader business goals and supported the product’s successful market entry.

- Financial Planning and Revenue Strategy: Developed the initial P&L documents, with a focus on revenue generation and user acquisition strategies. This financial planning was crucial in securing stakeholder buy-in and ensuring the product’s financial viability from the outset.

- Multi-Account Management: Create and manage multiple current accounts, allowing businesses to organize their finances efficiently and track funds across different business areas.

- Fund Transfers: Transfer funds between accounts or to external parties, ensuring smooth and secure financial transactions to manage cash flow effectively.

- Payment Reception: Receive payments from customers via various methods, streamlining the process to improve cash flow and make it easier to manage receivables.

- Real-Time Account Statements: Download account statements in real-time, providing quick access to up-to-date financial information for better decision-making and financial reporting.

- Challenge: Many business owners expressed a need for processing payments via POS terminals, a capability that Lumi Business did not initially offer, making it challenging to onboard certain businesses.

- Solution: Partnered with a traditional bank to deploy a white-label card machine, addressing the demand and expanding the platform’s service offerings.

- Challenge: During the initial deployment of the new design, we encountered compatibility issues with a lesser-known browser, affecting a small segment of users.

- Solution: Paused the A/B experiments to resolve the compatibility problems. Collaborated with the frontend team to diagnose and fix the issues, ensuring the design functioned correctly across all browsers. QA teams conducted thorough testing to confirm the fixes.